Many people who find themselves in need of filing a court accounting do not know where to start. We always recommend

There are three parts of a court accounting:

- The Beginning Inventory

- Receipts and Disbursements

- Distribute Remaining Estate Assets

1. The Beginning Inventory

One of your first steps of a court accounting is to take an inventory of the estate assets. This includes deciding on a fair market value for each asset and making sure that it is filed with the court.

The value of some items can be determined by financial statements depending on what the items are, such as bank accounts, stocks, and other securities. For other items, such as real estate, jewelry, or collectible items, they may need an appraisal.

After you take stock of the inventory, you will prepare and file an inventory form with the court. This form lists all the property that is in the estate and establishes the starting value of the estate assets. If there is money owed to the decedent that hasn’t yet been received, this will also be listed as part of the inventory.

2. Receipts and Disbursements

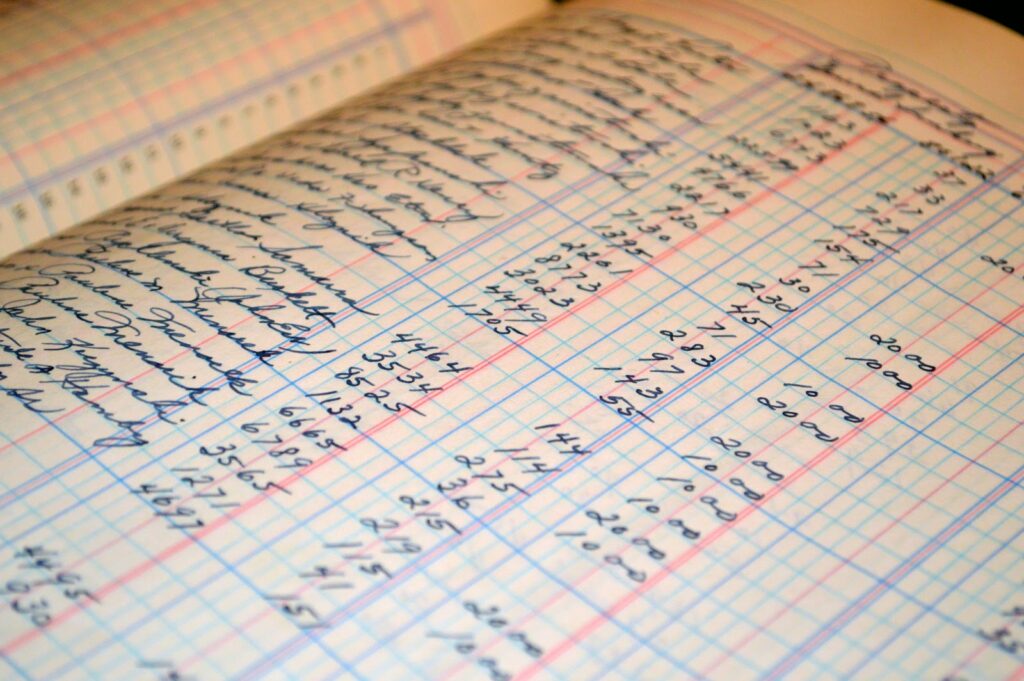

As the estate process progresses, you will want to make sure that you keep accurate records that show all income received and expenses paid. When keeping records, it is important that all income and expenses are labeled to describe what they are such as interest dividends for income, expenses paid such as the cost of death certificates and taxes paid, need to also be spelled out. In addition, there should be records of all assets sold or acquired from the date of the beginning inventory and sales need to be reported on a gain or loss schedule.

If the estate has accumulated any debt, this must be paid first. These expenses include funeral expenses, medical bills or any other debt that was accumulated over the decedent’s life.

To help keep adequate records, a new bank account must be opened for the estate with a separate EIN (employer identification number). All other accounts should be closed and the funds transferred into this account. Any brokerage accounts that exist should be closed and the assets transferred to a new brokerage account. Any funds received should be deposited in this account, and all payments should be paid by this estate account.

3. Distribute Remaining Estate Assets

Once all funds due to the estate have been received and all legitimate debts have been paid, remaining funds in an estate will get distributed once the court approves the accounting and the amount of the distributions to the beneficiaries.

Have more questions regarding court accounting?

Marcia L. Campbell, CPA, is committed to helping each client plan for the personal and financial decisions that need to be made for the future. Marcia’s team has a genuine interest in your well-being and a well-established list of services to help guide you through this process.

If you need help, please contact us by filling out our Contact Form or by giving our office a call at +1(951)686-3608.

Probate accounting is the detailed accounting of all the transactions undertaken by an estate within a particular reporting period. Trust accounting is often required by law when a trustee is appointed, terminated, or changed. It is also necessary when a current trustee brings a petition for the estate’s final distribution or closing.

Medical accountants not only help healthcare organizations navigate the complex financial landscape but also ensure that resources are managed efficiently to provide the best patient care possible.