Marcia Campbell | Certified Public Accountant

The beginning of the year is a busy time for most of us. Work, kids in school, and the dreaded tax return. It can be tempting to hurry, file your tax returns, then cross that item off your list.

Early in February, Congress reached a budget agreement in the Bipartisan Budget Act of 2018, which included “extenders” for provisions that expired at the end of 2016. Congress extended these provisions through 2017. That’s right, they made the provisions retroactive to Jan. 1, 2017. So, if you were an early filer, this action could affect your tax returns.

The provisions that most likely impact individual tax returns include:

–Exclusion from gross income of discharge of qualified principal residence indebtedness. This means if your mortgage company wrote off all or part of your mortgage debt, you received a 1099-C and reported that income on your tax return. The extender could give you the possibility of excluding that income.

–Mortgage insurance premiums treated as qualified residence interest. These payments did not show up on the 1098 you received at the beginning of the tax year, which means your deduction for mortgage interest was lower than it should have been on your original tax return.

–Above-the-line deductions for qualified tuition and related expenses. If you or a dependent went to school and had qualified expenses, the original tax return would not have used those amounts to reduce your income.

–Credit for nonbusiness energy property. Purchases of new energy-saving property now have the potential to give you a tax credit on your tax return. The most common improvements include exterior doors, windows, and skylights. Also, home insulation, certain roofing materials and central air conditioning systems.

–Credit for residential energy property. The most common type of this equipment is solar panels.

The following car credits were also extended:

Credit for new qualified fuel cell motor vehicles.

- Credit for alternative fuel vehicle refueling property.

- Credit for 2-wheeled plug-in electric vehicles.

These credits are only for qualified vehicles and have different credit amounts for each.

The important thing about credits is that they are a dollar-for-dollar reduction of the tax owed versus tax deductions which only reduce the amount of taxable income. The actual tax is calculated on the lower amount. Credits are much more beneficial to you.

Before the bill was signed, more than 18 million tax returns had been filed and processed by the IRS. Many of these returns could be affected by the extenders.

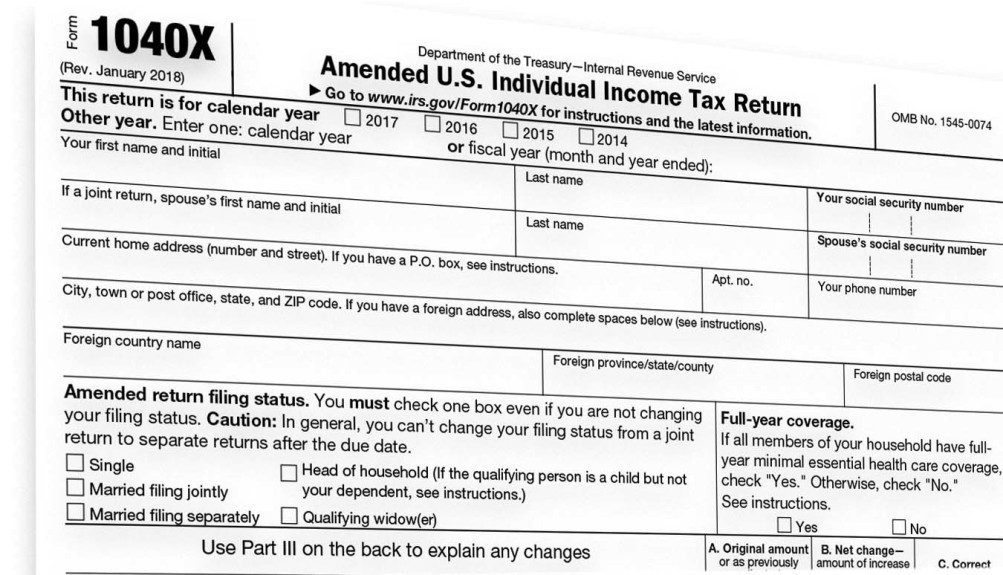

If you filed your tax return before February when the tax bill was signed, and one of the above items actually applies to you, you can file an amended return on Form 1040X. First, check with a tax preparer or a CPA; there may be other factors involved.

Each one of the credits has their own individual form that needs to be filled out and attached to the 1040X. These forms can be confusing which is another good reason to contact a tax preparer or a CPA.

You have three years from the date you filed your 2017 return or 2 years after you paid the tax due, whichever is later, to file an amended tax return. (In other words, you don’t have to get it done immediately.)

What if I haven’t filed my tax return yet?

If your tax return is on extension and you haven’t actually e-filed or mailed your tax return, you have the easier task. Just open your tax return, make the changes for the extenders and you are ready to file your return.

More changes?

Congress is working on an additional bill called the Tax Fairness for Workers Act that would reinstate the deduction for unreimbursed employee expenses. If passed, it would also make the deduction for union dues above-the-line so it would be available for everyone even if they don’t itemize.

It might be a wise decision to wait a few months to amend your tax return or file your extended tax return to see what other tax changes might happen!

By MARCIA CAMPBELL | Contributing columnist with THE PRESS ENTERPRISE

PUBLISHED: May 12, 2018

Marcia L. Campbell, has worked as a CPA for over 25 years specializing in seniors, trusts, estates, court accountings and probate litigation support. You can reach her at Marcia@MCampbellCPA.com